Comprehensive Guide on E-wallet App Development

Mobile app wallets, virtually well-known as eWallets, is the virtual mobile-based payment system where an individual can transact money with solid and robust security. The eWallet application development aims to help cashless payments and enable rapid money transactions without location and time constraints. Nowadays, businesses partner with mobile app development companies to design mobile wallet solutions that improve business transactions and revenue.

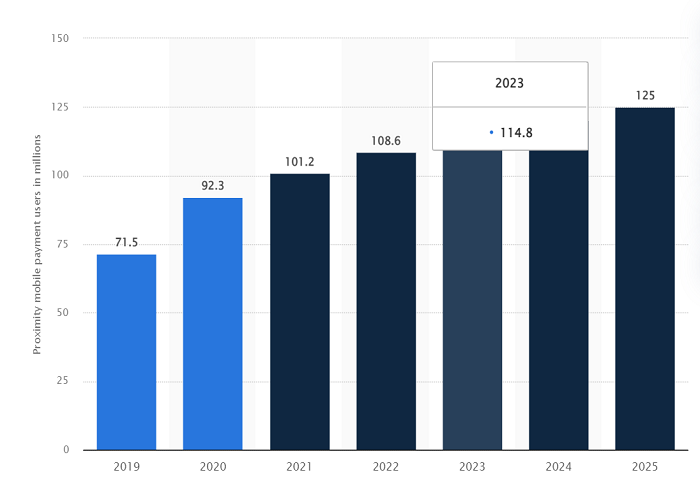

Number of presence mobile payment users in the United States in 2019 and 2020, with prediction from 2020 to 2025 (in millions)

For increasing buying and selling of services and goods, e-wallet development has proven its approach for businesses, especially in the eCommerce industry. UPI’s launch has made transferring money directly from banks easier and faster. EWallets help the business ecosystem and derive high profits for their firms. If you are planning to create a custom eWallet mobile application, this guide helps you search for the vital factors under successful mobile wallet app development.

Various types of Mobile Wallet Applications

1. Closed wallet

It is created for the particular store, app, or website to execute online transactions. Many enterprises issue these wallets to create brand awareness and promote their services and products to their targeted audience. An end user can use the closed wallet for money transactions with a wallet issuer. In any situation, a refund transaction, a refund amount is sent to the wallet. Examples of closed wallets are Amazon Pay and Ola Money.

2. Semi-Closed wallet

Businesses sign and accept the agreement with the eWallet Company for accessing the wallet app’s services and features. It enables the store owners and vendors to perform the money transmission at its locations. Venmo and Apple Pay are some examples of semi-closed wallets.

3. Open Wallet

It is the preferable type of eWallet on the global scale, enabling online transactions using a single platform. The most important criterion for this eWallet application is that the sender and receiver both have an account on similar applications.

Businesses who use this type of eWallet application

a. eCommerce industry

Mobile apps have made it simple and more accessible when discussing online food ordering, home decor systems, and healthcare consultations. The E-commerce industry has recently witnessed high popularity and built a bridge between buyers and vendors. The Company is significantly boosting its business performance and the customer experience due to the high demand for eWallet apps. A secure payment gateway integration has made online transactions secure in the eCommerce industry.

b. On-demand Food and Grocery Delivery

In the recent era, online grocery and food delivery growth and rise are becoming high. The ease of getting household necessities at the doorstep is the prime reason behind the hike in this industry. Implementing the eWallet in grocery delivery apps and food delivery app development has simplified the payment transactions with end users. Hence, they earn profits and coupon rewards to enhance the customer experience.

c. Taxi Booking Application

There is a new trend in the market to go cashless without carrying any money and remain tension free. Incorporating eWallet into the on-demand taxi app development enables travelers to make exclusive use of cashless services. User has the authority to pay the estimated fare with their mobile wallets using UPI ID, Scan the QR code or mobile numbers after reaching their destination.

d. Online Bill Payment

It is one of the app’s most crucial and lovable functionality and is liked by all consumers. Small to large businesses have shifted to online payment services, frequently sending reminders. Sometimes, customers forget to pay their bills; at that time, the eWallet app sends notifications for the pending payments and the due dates. It has removed standing in the long queue to pay the electricity bill, phone bill, water bill, etc. It is the effortless features of the billing system, and pay at the convenient home with just a few clicks.

e. Ticket Booking Apps

Apps like Paytm and Google Pay have made the ticket booking process more manageable and straightforward as now people are not keen to stand in long queues for window ticket booking. Integrating the eWallet app into ticket booking apps supports businesses to grow faster and provides a remarkable user experience. It has made the trouble-free ticket booking system that provides

Key features to integrate into your mobile wallet

1. Instant payments between wallets

This feature enables faster money transactions between payer and payee wallets within seconds. Customers didn’t need to wait for hours or business days to get transactions done. This feature facilitates payment and immediate funding options and enhances control over your funds anytime.

2. Payments from and to bank accounts

Mobile wallets allow flawless money transfer to any of the bank accounts from another but clarify that you have entered the correct account number of sender and receiver both. eWallet mobile app provides an easy process to send money. The client must fill in specific details like bank account number, bank name, and IFSC code and proceed.

3. Quick bill payments

Today people are going digital and like to pay every online bill mode. It can be house rent, loans, credit bills, utilities, etc.; people opt to pay eCash. With a mobile wallet app development concept, users can make effortless bill payments, whether postpaid or prepaid.

4. Management of Physical and Virtual Card operations

This feature will keep track of the users’ credit or debit card, which is utilized to make money transactions anytime or anywhere. An eWallet development has integrated customer finance, aggregating its card on a single platform. However, it eliminates the requirement of carrying the card physically as it saves the details of cards, like card numbers, in the encrypted format under robust security. Mobile wallets can manage several card operations like pin resetting, account limit, and many more.

5. Contactless Payment via the QR code scanner or NFC

In the current scenario, entrepreneurs are looking ahead to implement new technologies that accept money transactions through the mobile wallet. Retail clients can execute successful in-store payment transactions with eWallets and contactless processes like NFC (near-field communication) and the QR code scanner. Clients can use their smartphone camera to scan the QR code and interpret the barcode. Focusing on the growing demand for cashless payment, QR code payment methods and NFC must feature in the mobile wallet.

6. Robust data security

It offers digital transaction services; robust security comes first. Online money transactions must be safe and secure with robust security features like end-to-end encryption, security questions, and one-time password (OTP) via SMS. Moreover, online money transactions provide more security than physically carrying cash, debit, or credit card. But still, new consumers think about security aspects before using a mobile wallet. Therefore, e-wallets must support robust security features and end-to-end security capabilities to achieve customer loyalty.

7. Easy and fast self-registration

The concept of e-wallet app development will revolve around saving people’s time and efforts. An app should offer a seamless and effortless self-registration process. Moreover, the registration process is one of the essential steps that leaves a long-lasting impact on the customer experience; you must ignore to add the significant values and data input fields. A one-time registration process should be accurate and easy to keep the users engaged with your app.

8. Rewards, Coupons, and Discounts

The marketers and sales team do not hide the power of the rewards and coupons. eWallets is an ideal environment to offer deal-seeking customers the benefits in the relevant context. Hence, the features of easy creation and managing discounts, coupons, tickets, etc., are vital for the enterprise mobile app development to implement the eWallet that supports your app to stand out in the market.

9. Analytical dashboard

A periodic tracing of personal financial transactions is necessary for every consumer. We are all required t keep a record of every amount we spend. This dashboard lets wallet users view and track financial operations via stats, figures, and diagrams. Personal financial tracking supports the users to be informed about financial decisions with the transparency of when and where they have invested the money.

10. Chatbot integration

A software program chatbot establishes communication with the end-user. A chatbot integration in mobile wallet app development opens a new way to engage with the targeted audience and improve customer service. A chatbot integration into the eWallet app makes the service available 24*7 at a very minimal cost. So, chatbots are an excellent addition to boosting customer satisfaction.

How to figure out the eWallet app development cost?

The eWallet application development cost can be estimated by various factors. The overall wallet cost depends on whether you opt for in-house app development or hire a reputed mobile app development company. If you prefer a company with experienced and talented developers, below are some factors to find the overall development cost.

App design

A mobile application design is critical in driving customer engagement and attention. The intuitive e-wallet application development will offer seamless performance on almost every platform, including emerging technologies, UI/UX design, and creative elements, which comes at a high cost.

Integrated features

Multiple features and functionalities implemented into the app are the most vital factor influencing app development cost. If you develop the app with limited functionalities, it fits under the expected budget, but if you want unique features at an advanced level, then the development cost is high.

Development platform

Mobile app development affects overall development cost. The charge of the eWallet application developed for the iOS platform is less than the Android. Moreover, the eWallet mobile app is majorly developed for both platforms.

Developers skill set

When you hire a senior or experienced developer for eWallet development, the cost depends on their skill, experience, and industry knowledge. The cost of hiring them is generally higher than the junior developers.

Conclusion

The rise of mobile wallet app development has revolutionized the whole market. We provide the end-to-end app development services for your global business needs. Our wallet development process revolves around scalability, security, network testing, and continuous monitoring. Let’s make the mature decision and plan the unique and innovative eWallet app development that will allow dual business growth. We aim to support valuable clients and help them gain a leading position in this competitive world. If you are keen to know the step by step process of mobile app development then we will assist you in every manner.

Frequently Asked Questions (FAQs)

1. What is e-Wallet architecture?

A digital wallet is connected with end-user, bank, or vendor applications and gives the app the management instrument and protocol management services. These digital wallets are interconnected with the vendor and its bank accounts, which offer these management services similarly to the end-user digital wallets.

2. How much time does it take to reflect money in your wallet?

This process is faster but takes around 4 to 15 working days to reflect in your account.

3. Why is eWallet better than cash?

Digital wallets are safer than credit, debit cards, or cash. It offers a better shopping experience and is also easy to keep track of every transaction. It provides an advantage to retailers as well as end-users.

Book your appointment now